As you embark on an exciting journey to explore the wonders of the United Arab Emirates, you’ll likely indulge in shopping for unique souvenirs, exquisite goods, and delightful experiences. While enjoying your travels, you might have noticed that the United Arab Emirates imposes a Value Added Tax (VAT) on various goods and services. However, as a gesture to support tourism, the United Arab Emirates government extends a VAT Refund for Tourists scheme, allowing you to claim your VAT back before you depart. This guide is designed to help you navigate the process of claiming your VAT refund at the airport, ensuring that you can make the most of your shopping experiences in the United Arab Emirates.

Understanding VAT Refunds for Tourists:

VAT commonly applied to goods and services, is a consumption tax levied at each stage of the supply chain. In the United Arab Emirates, the standard VAT rate is 5% of the purchase price. For tourists, this means that when you buy eligible goods or use eligible services, you’ll pay the VAT upfront. However, fear not, as claiming VAT back at the airport is a hassle-free process, designed to promote tourism and encourage spending.

Eligibility Criteria for VAT Refunds:

Before diving into the process of claiming tax back at the airport, it’s essential to ensure that you meet the eligibility criteria for the VAT Refund for Tourists scheme. As a tourist, you must have a non-resident status and plan to exit the United Arab Emirates within the specified time frame. Additionally, your purchases should meet the minimum spending threshold set by the UAE Federal Tax Authority. Be sure to familiarize yourself with the list of eligible goods and services to avoid any surprises when claiming your tourist tax refund.

How to Shop Tax-Free and Obtain VAT Refunds:

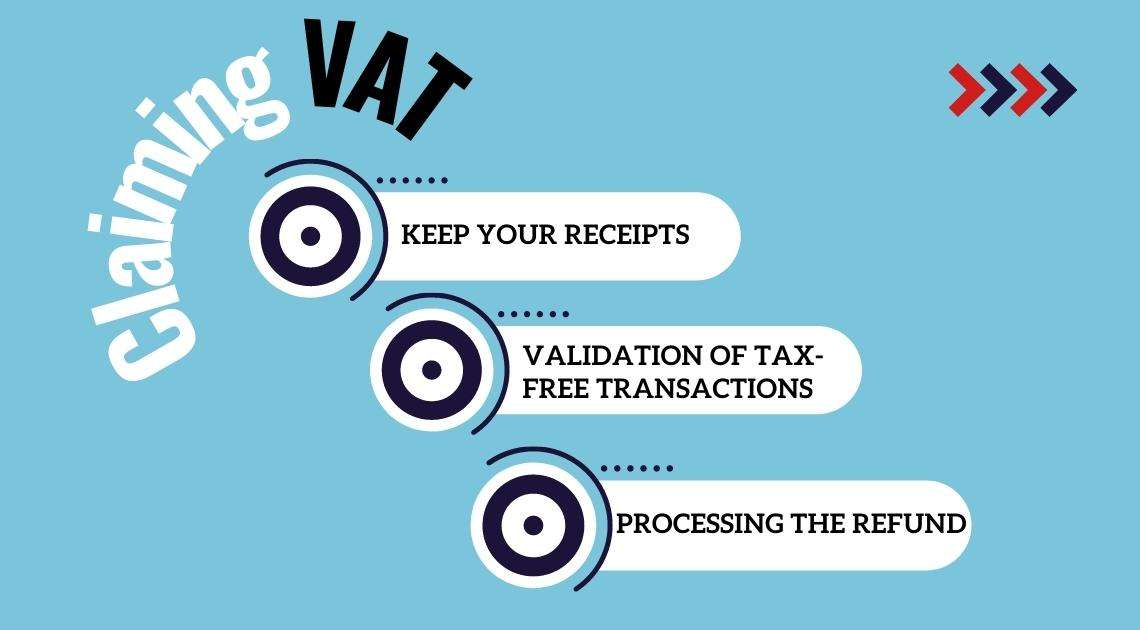

Claiming VAT back at the airport is a straightforward process, but it requires attention to detail. Here’s a step-by-step guide to help you along the way:

- Keep Your Receipts:When shopping in the United Arab Emirates, request a tax invoice from the retailer for each qualifying purchase. The invoice should clearly display the VAT amount paid, which will be essential for your VAT Refund at the Airport. Also, obtain a tax-free tag on the invoice.

- Validation of tax-free transactions:Upon departing the United Arab Emirates, make sure to allow ample time to visit the self-service kiosks at the airport or designated tax-free validations desks. Present your original tax invoices along with tax-free tag on them, and the goods (if requested for inspection). This validation process is essential to ensure a smooth tourist tax refund experience.

- Processing the Refund:Customs officials will verify your documents and approve your VAT Refund at the Airport. You can choose to receive the refund in cash or have it credited to your credit card or bank account through Planet Payment Tax Refund service for added convenience.

Filing and Processing VAT Refunds:

It’s crucial to file for your VAT refund promptly to avoid any processing delays. Keep in mind that each VAT refund scheme may have specific procedures and timeframes for processing. Generally, airport tax refund claims are processed efficiently, ensuring you get your money back promptly to enjoy even more adventures in the United Arab Emirates.

Tips and Best Practices:

To make the most of the VAT Refund for Tourists process, here are some tips:

- Always ask for a tax invoice with a tax-free tag on it to maximize your chances of claiming VAT back at the airport.

- Keep all your receipts, travel documents (GCC National ID or Passport, Boarding pass, and Ticket) and paperwork organized throughout your trip, making the tax return at the airport a breeze.

- Be aware of the eligible goods and services to ensure your purchases qualify for a VAT refund.

- Avoid last-minute refund attempts, especially during busy travel periods, as this can streamline the airport tax refund process.

Exploring the United Arab Emirates is an enriching experience, and the VAT Refund for Tourists scheme is a fantastic opportunity to enhance your journey further. By understanding the VAT refund process and following the guidelines outlined here, you can confidently claim your well-deserved VAT refund at the airport and return home with not only cherished memories but also some extra savings to plan your next adventure.

Remember, each country may have variations in its VAT refund scheme, so it’s always a good idea to refer to the official UAE Federal Tax Authority website (https://tax.gov.ae/en/default.aspx) or consult with customs officials for the most up-to-date information.

Happy travels and happy shopping!

BONUS Info: Click on this link to download the UAE Tax Authority’s Guide to Tax Free Shopping PDF.

Why Spectrum Auditing?

Being a pioneer in the field of auditing, accounting, taxation and advisory services, we ensure we keep track of all the changes that are taking place in the UAE with respect to the changes in laws, rules, regulations and keep our clients informed as well as sharing the same information through our blog section or social media handles regularly. Spectrum Auditing will guide you with the laws and regulations of UAE, be it Economic Substance Regulations (ESR), Corporate Tax (CT), Transfer Pricing (TP), Ultimate Beneficiary Owner (UBO), Anti Money Laundering (AML), etc after reviewing your business.

Call us today for any kind of assistance at +971 4 2699329 or email [email protected] to get all your queries addressed. Spectrum is your partner in your success.

contact us

contact us