Tax systems have been diversified and modified across the globe over a period of time. In most of the modern tax systems VAT (Value Added Tax) is very popular and commonly heard everywhere and anywhere. VAT is a type of consumption tax which has been introduced in UAE since 2018 to provide an alternate revenue for the development of the country, not to completely depend on the hydrocarbons as the source of income.

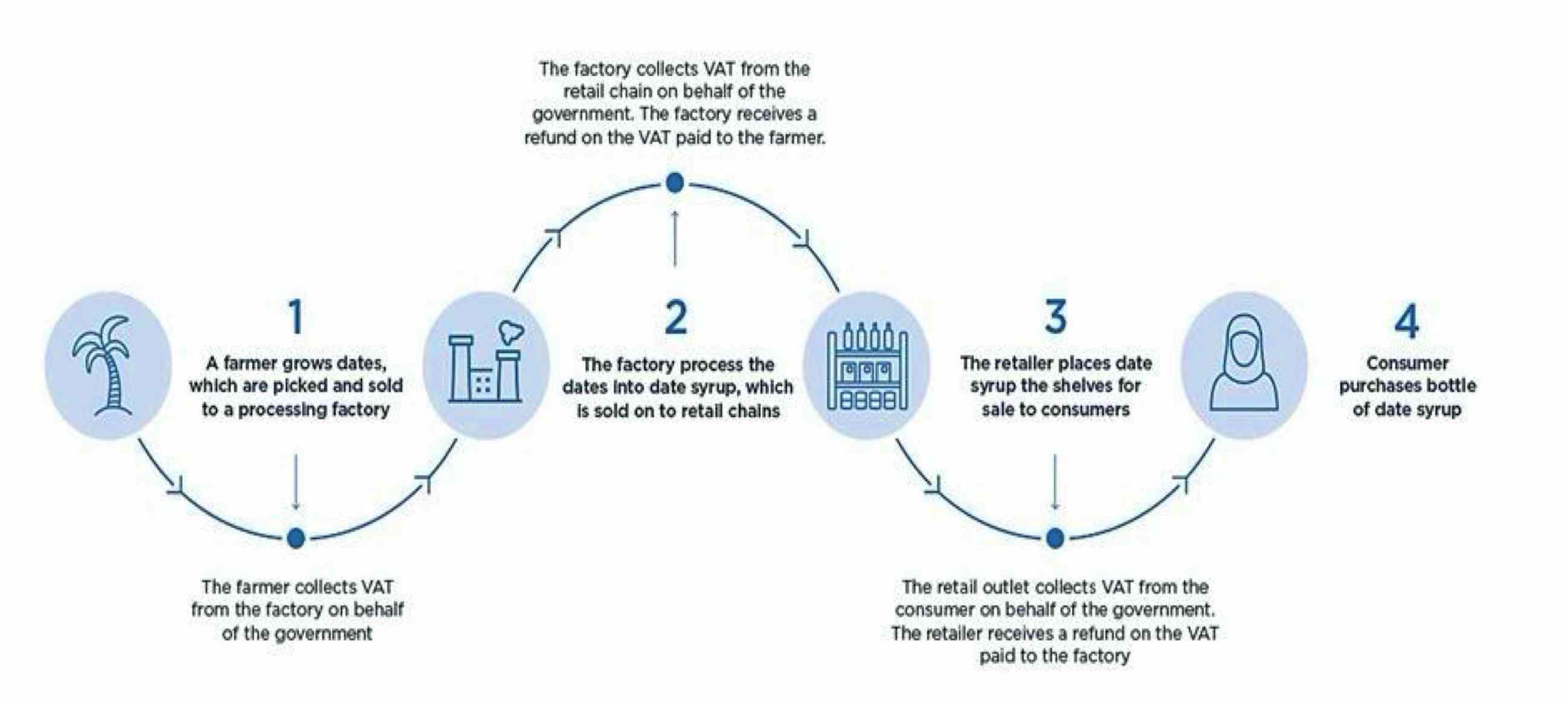

The government has implemented a VAT of 5% on the supply of all taxable products and services on each step of the supply chain. The picture below demonstrates the VAT collection in UAE.

The Federal Tax Authority (FTA)’s vision is to ensure the stability of UAE’s tax system to encourage organized businesses and corporations to set up their facilities in the country. The FTA / Tax audit of enterprises is now a reality after the implementation of VAT to verify tax compliance of the businesses registered in the UAE. A tax audit is a check of financial records, documents, taxes paid, turnover declared, refunds claimed and assess about a company’s taxable entity.

FTA performs these tax audits to make sure that each and every liability is paid and taxes due is all paid to the government within the given time. FTA helps the government to evaluate an enterprise based on the tax laws and on the other hand also support the business communities by providing easily accessible information online such as e-learning guides and business bulletins about the changes in the taxation.

The FTA Audit Process

The FTA / Tax audit can be conducted at any point of time without any precise reason. The FTA authorities will scan through the tax returns, documents like sales & purchase invoices, customs and VAT documents related to import and export of goods and services.

A prior notice will be posted at least five days before the planned audit date. This notice will contain important details about the audit schedule, all the parties involved will be listed out to be present at the audit and if there is any particular reason for the trigger of the tax audit.

The FTA / Tax audits are classified into two types – Correspondence and Field Audits:

Correspondence Audit – The most common kind of the audit might happen when FTA is suspicious about any possible errors related to the company’s tax returns. At this instance the company can respond with appropriate documentation to demonstrate the evidence of proper tax filing.

Field Audit –The FTA sends a field examiner to inspect the key areas of tax compliance in the office of the company. The FTA examiner will scrutinize the firm’s financial records to tally with the tax returns and comply with the UAE tax laws.

It is the duty of FTA to examine and verify the tax declarations of registered businesses to ensure a flawless tax regime.

Although the chances of being selected for an FTA audit is very little for most of the enterprises. However by any reason if a company is selected, it should have a panel of professionals to deal with the audit.

Are you prepared for the Audit?

Spectrum can prepare you with an efficient and comprehensive documentation as well as review your financial records which definitely means less legwork for you and more solutions to your problems. We can help you be more organized without any worry about the audit.

contact us

contact us