As per OECD guidelines, entities required to compute Arm’s Length Price (ALP) should compute it using the most appropriate method. Since UAE Corporate Tax public consultation document refers to the guidelines provided by the OECD, hence resale price method can be considered as a useful method and can be applied for UAE Corporate Tax.

Any entity must follow this method when price at which goods or services obtained by the enterprise from a related party is resold to an unrelated party.

As per the guidelines of OECD, “the resale price method begins with the price at which a product that has been purchased from an associated enterprise is resold to an independent enterprise. This price (the “resale price”) is then reduced by an appropriate gross margin (the “resale price margin”), determined by reference to gross margins in comparable uncontrolled transactions, representing the amount out of which the reseller would seek to cover its selling and other operating expenses and, in light of the functions performed (taking into account assets used and risks assumed), make an appropriate profit. What is left after subtracting the gross margin can be regarded, after adjustment for other costs associated with the purchase of the product (e.g. customs duties), as an arm’s length price for the original transfer of property between the associated enterprises.”

Following adjustments are generally expected to be done to the selling prices to the unrelated party by the related party under resale price method:

- Normal gross profit margin related to the sale made by the related party to an unrelated and uncontrol party

- Expenses in connection to purchase of goods or services after purchase till they are sold to an un-related party

- Adjustments in relation to any other functional differences

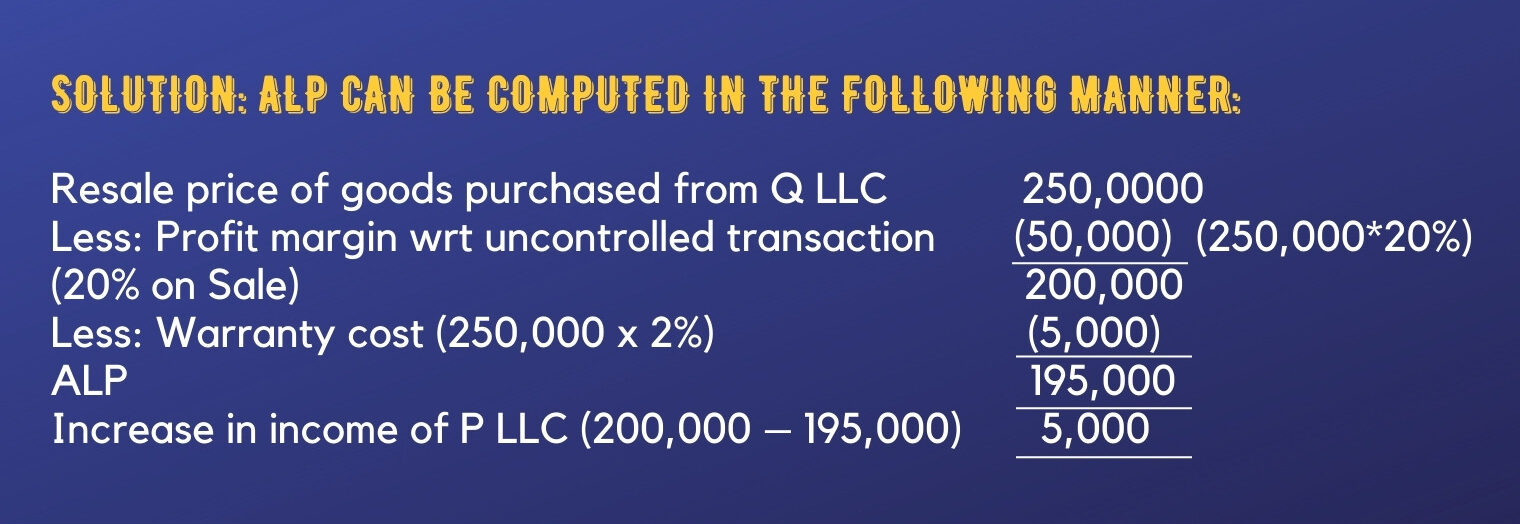

For E.g. P LLC is engaged in trading of electronic goods. It purchases goods from its related Q LLC worth AED 200,000 & sold to R LLC, unrelated party for AED 250,000. The GP margin on sale of goods of Q LLC is 15% while that of unrelated party is 20%. After sales warranty is provided of 1 year by Q LLC while. Warranty cost may be taken as 2% of sale price.

Why Spectrum Auditing?

Reach out to Spectrum Auditing for any details pertaining to UAE Corporate Tax. Call us today for any kind of assistance at +971 4 2699329 or email [email protected] to get all your queries addressed. Spectrum is your partner in your success.

AUTHOR

Senior Audit Executive

contact us

contact us