The UAE introduced Economic Substance Regulations pursuant to Cabinet of Ministers Resolution No.31 of 2019(“Regulations”) on 30 April 2019. Guidance on the application of the Regulations was issued on 11 September 2019 pursuant to Ministerial Decision No. 215 of 2019 (“Guidance”).

The Regulations require companies and other business forms registered in the UAE that carry on one or more “Relevant Activities” (together, “Relevant Activities”), to have economic substance in the UAE in relation to these activities, and to comply with notification and return filing obligations. Such businesses are referred to in the Regulations and this document as “Licensees”.

To support UAE businesses in understanding the scope and application of the Regulations, this article provides additional guidance on the “Relevant Activities” and their associated “Core Income-Generating Activities” (“CIGAs”).

- Assessment of whether an entity is undertaking a Relevant Activity

The Regulations apply to companies and other business forms registered in the UAE, including in a Free Zone or in a Financial Free Zone, that carry out any of the following Relevant Activities.

- Banking Businesses

- Insurance Businesses

- Investment Fund Management Businesses

- Lease-Finance Businesses

- Headquarters Businesses

- Shipping Businesses

- Holding Company Businesses

- Intellectual Property Businesses

- Distribution and Service Centre Businesses

UAE businesses are expected to use a ‘substance over form’ approach to determine whether or not they undertake a Relevant Activity and, as a result, are within the scope of the Regulations. This determination would require the UAE business to not only consider the activities stated under their commercial licence or registration certificate but also to assess the activities carried out during a financial period.

It is not required that a UAE business is actively engaged in any of the above business categories for it to be considered as carrying on a Relevant Activity. For example, the passive receipt of income under a finance lease would be considered as carrying on a Lease-Finance Business.

Licensees can undertake more than one Relevant Activity during the same financial period. This would require the Licensee to demonstrate economic substance in respect of each Relevant Activity, unless the other Relevant Activities are ancillary to a main Relevant Activity. In certain instances the Licensee can consolidate the ancillary Relevant Activities under the main Relevant Activity to prevent duplicate reporting. The following sections discuss instances of where consolidated reporting may be permitted:

- Section 3.1: Banking Business;

- Section 3.4: Lease-Financing Business;

- Section 3.5: Headquarters Business; and

- Section 3.9: Distribution and Service Centre Business.

A Licensee is subject to the Economic Substance Test set forth in the Regulations from the date on which the Licensee commences carrying the Relevant Activity, or for financial years commencing, on or after, 1 January 2019, where the Licensee was in existence before the effective date of the Regulations.

- Relevant Activities and Core Income-Generating Activities

Whether or not a UAE business undertakes a Relevant Activity determines whether the entity is a “Licensee” that is within the scope of the Regulations1.

1Although a business may determine that it does not carry on a Relevant Activity and is therefore not within scope of the Regulations, the Regulatory Authority in that jurisdiction may request information from the business to demonstrate that position.

A Licensee needs to demonstrate economic substance and file an economic substance return in respect of those financial periods in which any gross income was earned from a Relevant Activity,

For the purposes of the Regulations , “gross income” means all income from whatever source derived, and in whatever form realised, including revenues from sales of inventory and properties, services, royalties, interest, premiums, dividends and any other amounts.

One of the requirements to demonstrate economic substance is that a Licensee needs to undertake the CIGAs in relation to its Relevant Activity (or Relevant Activities) in the UAE. The CIGAs are those activities that are of central importance to the Licensee for the generation of the gross income earned from its Relevant Activity.

The Guidance clarifies that the CIGAs listed in the Regulations for each Relevant Activity are not an exhaustive list of all CIGAs in respect of each Relevant Activity. It is not necessary for a Licensee to perform all of the CIGAs listed in the Regulations. A Licensee should therefore consider the activities from which it generates gross income and ensure that those CIGAs are performed in the UAE.

Where the CIGA involves making relevant decisions, then the majority of the persons making the decisions must be present in the UAE when the decision is made, in order for a decision to be considered as being made in the UAE.

The following sections discuss the intended scope of each Relevant Activity and their corresponding CIGAs, and give examples of scenarios where a Licensee may, or may not be, subject to the Regulations, based on its activities.

The examples in this Relevant Activities Guide are meant as general guidance in the context of the specific Relevant Activity being discussed in the respective section. UAE businesses should consider whether the activities described under any of the examples could constitute another Relevant Activity.

3.1 Banking Business

“Banking Business” means the business of accepting deposits of money which may be withdrawn, or that are repayable on demand or after a fixed period, or after notice, by cheque or otherwise, and the use of such deposits, either in whole or in part, in:

- the making or giving of loans, advances, overdrafts, guarantees or similar facilities; or

- the making of investments,

for the account and at the risk of the Licensee.

Licensees undertaking a Banking Business in the UAE would generally be licensed as a “Commercial Bank”, or an equivalent licensing category that allows for the acceptance of deposits, by either the Central Bank (for a Licensee established in “onshore” UAE), the Dubai Financial Services Authority (“DFSA”) (for a Licensee established in the Dubai International Financial Centre (“DIFC”)), or the Financial Services Regulatory Authority (“FSRA”) (for a Licensee established in the Abu Dhabi Global Market (“ADGM”)). A Licensee that is part of a banking group and only provides advisory, arranging and other services to clients of the banking group would generally not be considered to conduct a Banking Business (although such Licensee should consider whether it undertakes another Relevant Activity).

UAE businesses engaged in exchanging foreign currency and remitting money, and financial intermediaries in the sale and purchase of domestic and foreign stocks and bonds, currencies and commodities and money market transactions, are not considered a Banking Business for purposes of the Regulations.

Licensees engaged in a Banking Business may also provide services, or perform lease or financing activities as a normal part of their business operations. To prevent duplicate reporting, such Licensees are not also considered engaged in a separate Distribution and Service Centre Business or Lease-Finance Business and will not need to separately demonstrate economic substance in respect of such ancillary Relevant Activities.

Core Income-Generating Activities of a Banking Business

The Regulations mention the following CIGAs for a Banking Business:

- ‘Raising funds, managing risk including credit, currency and interest risk’ – In addition to accepting deposits from the public, raising funds also includes raising capital, issuing bonds or going to the money markets. A Banking Business’ risk management activities would be aimed at ensuring the capital base of the Licensee is not eroded and to control the cost of funds. The key functions and related decision-making in respect of these activities are expected to be performed in the UAE.

- ‘Taking hedging positions’ – Where the Licensee mitigates risks by taking opposing or offsetting positions, the Licensee must be able to demonstrate that the related activities and decisions making take place in the UAE.

- ‘Providing loans, credit or other financial services to customers’ – A Banking Business would be expected to lend or otherwise invest its customer deposits and other available funds. The term “customer” is not limited to individuals, but also includes corporations and other financial institutions.

- ‘Managing capital and preparing reports to investors or any government authority with functions relating to the supervision or regulation of such business’ – The banking sector is highly regulated, and involves various reporting to regulators and investors. The Licensee is expected to perform and oversee its reporting related functions and activities in the UAE.

Examples:

- ABC Bank (UK) offers current accounts, savings accounts, loans, credit cards, and other products and services to individual and corporate customers through a number of branches in the UAE. ABC Bank clearly undertakes a Banking Business in the UAE and is subject to the Regulations.

- PQR is a UAE branch of the Investment Banking division of the STV Banking Group. The activities of PQR include underwriting new debt and equity securities, facilitating and advising buyers and sellers on mergers and acquisitions, and marketing financial products. Whilst permitted under its UAE investment banking license to accept deposits whose maturities are at least two years, PQR’s funding is limited to borrowings from its head office and from other banks. PQR would not be considered as carrying on a Banking Business and be subject to the Regulations on this basis.

- MNO is the UAE branch of the JKL Banking Group that provides retail and corporate banking services globally. The activities of MNO are limited to providing UAE and regional clients with assistance and advice regarding the JKL Banking Group’s products and services, including assistance in the process of opening accounts with JKL Banking Group entities that are based outside of the UAE. MNO LLC is not considered to undertake a Banking Business by virtue of being in the same corporate group, and assistance in the opening of bank accounts would not be considered as conducting deposit taking activities. MNO may, however, be considered as undertaking a “Distribution and Service Centre Business” and be within the scope of the Regulations on this basis.

3.2 Insurance Business

Insurance Business means the business of accepting risks by effecting or carrying out contracts of insurance, in both the life and non-life sectors, including contracts of reinsurance and captive insurance arrangements.

A UAE business that carries on an Insurance Business would be regulated by either the UAE Insurance Authority (for a Licensee established ‘onshore’), the DFSA (for a Licensee established in the DIFC), or the FSRA (for a Licensee established in ADGM).

To prevent duplicate reporting, Licensees providing captive insurance services are not also considered engaged in a Distribution and Service Centre Business.

Insurance brokers, agents, and other UAE businesses providing insurance related services that do not involve assuming all or some of the insured risk do not fall within the definition of Insurance Business, although they may conduct activities that fall into another Relevant Activity category.

Core Income-Generating Activities of an Insurance Business

The Regulations mention the following CIGAs for an Insurance Business:

- ‘Predicting and calculating risk’ – This CIGA involves the determination of the quantification and likelihood of the insured event occurring and the likely costs, and ensuring that the premiums charged are commensurate with the risks accepted.

- ‘Insuring or re-insuring against risk and providing Insurance Business services to clients’ – This CIGA includes insuring policyholders against specific risks and providing reinsurance to primary insurers.

- ‘Underwriting insurance and reinsurance’ – This CIGA refers to the evaluation and analysis of the risks of an insurance policy, and establishing the pricing for accepted insurable risks.

Examples:

- First Life LLC (UAE) provides life, health and car insurance in and from the UAE, and is regulated as an Insurer by the UAE Insurance Authority. First Life LLC clearly undertakes an Insurance Business and is subject to the substance requirements.

- IntermediaryCo LLC (UAE) is an insurance intermediary that assists and represents consumers in the placement and purchase of insurance, and provides services to insurance companies to facilitate and complement the insurance placement process. IntermediaryCo is regulated as an

insurance broker, but is not required to be regulated as an Insurer. IntermediaryCo does not undertake an Insurance Business and is not subject to the Regulations on this basis.

3.3 Investment Fund Management Business

The definition of an Investment Fund Management Business encompasses Licensees that provide discretionary investment management services in relation to domestic or foreign “Investment Funds”.

Discretionary Investment Fund Management services include making investment, divestment and risk related decisions on behalf of an Investment Fund. UAE businesses providing fund administration, custodian, investment advisory, and other Investment Fund related services are not considered engaged in an Investment Fund Management Business.

The Investment Fund itself is not considered an Investment Fund Management Business, unless it is a self-managed fund (the Investment Manager and the Investment Fund are part of the same entity).

Where an Investment Fund is structured as a partnership and has both a corporate General Partner and an Investment Fund Manager, only the Investment Fund Manager would be subject to the Regulations if the General Partner does not undertake business activities separate from its role as General Partner of the Investment Fund.

Core Income-Generating Activities of an Investment Fund Management Business

The Regulations mention the following CIGAs for an Investment Fund Management Business:

- ‘Taking decisions on the holding and selling of investments‘ – This CIGA involves the independent consideration, deliberation and making of investment and divestment decisions. A licensee that is merely implementing decisions of another entity with respect to the holding and selling of investments without independent evaluation before taking steps or decisions to effect the investment or divestment decisions taken, does not perform the CIGA. It is a commercial reality that the directors or members of an investment committee may not all be based in the UAE or be physically present in the UAE when investment and divestment decisions are taken. However, for this CIGA to be seen as taking place in the UAE, the majority of those making the decisions should be physically present in the UAE when the decisions are made.

- ‘Calculating risk and reserves’ – Managing an Investment Fund involves identifying, measuring, monitoring and controlling risks attributable to the Investment Fund’s operations and investments. This CIGA refers to activities in respect of risks for the Investment Fund as a whole, as opposed to isolated risk calculations for one area of applicable risk that does not take into

account all relevant risks applicable to the Investment Fund and the reserves required on a holistic basis.

- ‘Taking decisions on currency or interest fluctuations and hedging positions’ – This CIGA refers to the activities required to determine if the Investment Fund is exposed to, or if it is in the best interests of the Investment Fund to enter into, hedging arrangements against currency or interest fluctuations, and taking relevant decisions regarding those determinations. As with the other CIGAs, the Investment Fund Manager is expected to perform this activity on a holistic basis, taking into account the Investment Fund’s overall position. Isolated decisions involving specific investments are not sufficient to meet the CIGA requirement.

- ‘Preparing reports to investors or any government authority with functions relating to the supervision or regulation of such business’ – This CIGA does not require the Licensee to perform the administrative task of compiling the various routine annual or quarterly reports. However, the Licensee is expected to oversee this work from the UAE and to ensure the necessary systems and processes are in place, including the contractual arrangement with any third party administrator. The Licensee is also expected to have the ultimate responsibility for the reporting, and to have the necessary understanding and knowledge to accurately convey the position of the Investment Fund(s) at any time.

Example:

Trinity Fund is an Investment Fund registered with the SCA. The fund is structured as a limited partnership with Trinity LLC (UAE) as its corporate General Partner. Trinity LLC has appointed Morpheus LLC (UAE) as the investment manager for the Trinity Fund, and has delegated to Morpheus LLC the day-to-day investment and divestment decision making responsibilities. The administration of the Investment Fund is handled by a third-party administrator established in the UAE, Neo LLC.

Trinity Fund itself is not considered to undertake an Investment Fund Management Business.

Trinity LLC, on the basis that its activities are limited to being the General Partner of the Trinity Fund, with all discretionary investment management activities being delegated to Morpheus LLC, is not considered to undertake an Investment Fund Management Business.

Morpheus LLC, as the investment manager of the Trinity Fund, is considered as carrying on an Investment Fund Management Business.

Neo LLC does not provide discretionary investment management services and is therefore not considered an Investment Fund Management Business.

3.4 Lease-Finance Business

The definition of a Lease-Finance Business encompasses Licensees that offer credit or financing for any kind of consideration, and includes intra-group financing.

Offering credit or financing includes making loans to related or unrelated parties, entering into finance leases in relation to assets other than land, and providing credit in the form of hire purchase agreements, long term credit plans, and other types of financing arrangements.

Besides interest, consideration for the purpose of a Lease-Finance Business would also include origination and processing fees, gains upon conversion of a loan into the share capital of the debtor, and late payment penalties. However, granting of security in favour of the lender would not constitute consideration.

When there is no expectation of consideration from the credit at the time it is provided, the UAE business will not be considered as carrying on a Lease-Finance Business.

The investment in bonds or similar securities or debt instruments that are traded on a regulated exchange would also not be considered a Lease-Finance Business.

Licensees engaged in Banking, Insurance, and Investment Fund Management Business may also perform lease or financing activities as a normal part of their business operations. To prevent duplicate reporting, such Licensees are not also considered engaged in a Lease-Finance Business and will not need to separately demonstrate economic substance in respect of any ancillary Lease-Finance activities.

Core Income-Generating Activities of a Lease-Finance Business

The Regulations mention the following CIGAs for a Lease-Finance Business:

- ‘Agreeing funding terms’ – This CIGA relates to the funding of the Licensee itself, and includes agreeing the type of funding (e.g. equity, preference shares, debt, etc.), the quantum of funding, the currency, the rates of interest payable, the security given (if any), and any covenants.

- ‘Identifying and acquiring assets to be leased (in the case of leasing)’ – This CIGA refers to the activity of identifying and verifying suitable assets to purchase and then rent to a hirer or lessee for an agreed period, including negotiating the acquisition and the terms of the supply of the assets to be leased or hired.

- ‘Setting the terms and duration of any financing or leasing’ – The Licensee is expected to have the authority (within certain parameters, where applicable) and undertake the negotiation of

the amount of financing or leasing to be provided, the financial and other terms and conditions, and the relevant legal agreements to be entered into.

- ‘Monitoring and revising any agreements’ – This CIGA could include obtaining data about a borrower or lessee (or the group to which they belong), testing compliance against covenants, extending the duration or the changing of other terms of the financing provided, and ensuring all relevant information is fed into the decision making process and any amended financing terms.

- ‘Managing any risks’ – This CIGA refers to activities in relation to debt collection, monitoring and maintaining the conditions of the underlying leased assets (in the case of leasing), entering into swap and hedging arrangements, and developing and implementing strategies to reduce or spread risks.

Examples:

- STU LLC (UAE) lends AED 1,000,000 to its subsidiary, VWX LLC, at a 10% interest rate per annum. In respect of the interest bearing shareholder loan made by STU LLC, it is considered engaged in a Lease-Finance Business (specifically, financing).

- STU LLC subsequently assigns the AED 1,000,000 loan to YZ LLC (UAE), another group company.

After the transfer, YZ LLC will be considered as carrying on a Lease-Finance Business.

If the AED 1,000,000 loan was the only loan advanced by STU LLC, and STU LLC does not obtain an interest bearing loan receivable from YZ LLC in exchange for the transfer, STU LLC would cease to carry on a Lease-Finance Business once the transfer is effected.

- TradeCo LLC (UAE) sells office supplies and allows its customers a 45-day payment term on invoices. If customers do not pay within 45 days, TradeCo charges late payment interest.

This trade-credit arrangement is not a Lease-Finance Business, as the credit is not offered with the intention of generating interest, but rather to facilitate the trading business of TradeCo.

- TreasuryCo LLC (UAE) is part of the JMR group and acts as the central treasury center for the group. TreasuryCo enters into external borrowing arrangements and on lends the borrowed funds to group companies at the same interest rate it is being charged by the external funders.

Despite TreasuryCo not applying a mark-up on the interest it is being charged, it offers financing to group companies for consideration, and is thus considered to carry on a Lease-Finance Business.

3.5 Headquarters Business

A Licensee is regarded as carrying on a Headquarters Business if the Licensee provides services to foreign group companies, and through the provision of such services:

- The Licensee takes on the responsibility for the overall success of the group; or

- The Licensee is responsible for an important aspect of the overall group’s performance.

In order for a UAE business to be seen as having “taken on the responsibility for the overall or an important aspect of the overall group’s success or performance”, the services provided by the entity must involve:

– the provision of senior management;

– the assumption or control of material risk for activities carried out by foreign group companies; or

– substantive advice in relation to the assumption or control of such risks.

A Licensee’s position in a group’s corporate structure is not relevant for determining whether it is engaged in a Headquarters Business. The Licensee does not need to be the direct or ultimate parent of a group company for it to be considered a Headquarters Business; whether an entity carries on a Headquarters Business is entirely dependent on the nature of the services it provides to foreign group companies.

For Banking, Insurance, Investment Fund Management, Lease-Finance, Shipping or Distribution and Service Centre Businesses, it may be a normal part of their activities to provide headquarters services. To prevent duplicate reporting, such Licensees are not also considered engaged in a Headquarters Business, and will not need to separately demonstrate economic substance in respect of such activities.

Core Income-Generating Activities of a Headquarters Business

The Regulations mention the following CIGAs for a Headquarters Business:

- ‘Taking relevant management decisions’ – This CIGA refers to making decisions on the substantive functions and significant risks for group companies, such as decisions on material acquisitions and purchases, the group companies’ sales and marketing strategy, product development, business process standardization, etc. For a decision to be seen as being made in the UAE, the majority of those making the decision should be physically present in the UAE.

- ‘Incurring operating expenditures on behalf of group entities’ – This CIGA could include engaging specialist advice or procuring technology on behalf of the group as a whole, or purchasing significant assets or specific services for or on behalf of group companies.

- ‘Coordinating group activities’ – This CIGA refers to ensuring that activities such as marketing, HR, IT, finance, tax etc. are coordinated and organised in a way that produces the best outcome for the group as a whole as opposed to individual group companies.

Examples:

- PLC LLC (UAE) is part of a multinational group with subsidiaries around the world. Each of the senior management team based in the UAE has responsibility for a different region, and regularly spend time at the subsidiaries with the local management teams providing strategic direction and helping manage material risks. In addition, PLC LLC supports the group in managing risk through the procurement of external advice centrally, and the associated costs are shared amongst the group.

PLC LLC’s activities are within the scope of a Headquarter Business.

- FGH LLC (UAE) is part of a UK headquartered group and has subsidiaries in the Kingdom of Saudi Arabia (“KSA”). Whilst the senior management of FGH LLC have regular contact with the management of the KSA subsidiaries on the performance of their business and to share insights from the group, and FGH LLC (in its capacity as shareholder) has certain rights and influence in respect of the management and operations of the KSA subsidiaries, the KSA subsidiaries follow the strategic direction and manage risks in line with the corporate policy set by the headquarters based in the UK.

FGH LLC is not considered to be providing ‘headquarters services’ because the strategic direction for the group is set by the headquarters in the UK and not by FGH LLC, and FGH LLC is not responsible for the performance of the subsidiaries in KSA.

3.6 Shipping Business

To undertake a Shipping Business, a Licensee must operate one or more ships in international traffic, for the transport of either passengers, cargo or both.

The definition of a “ship” for purposes of the Regulations does not include:

- vessels used for fishing;

- vessels that are “small” (i.e. tonnage does not exceed ten tonnes); and

- leisure vessels (e.g. cruise ships and private yachts).

Further, the following activities will be considered a Shipping Business only where they are undertaken by a Licensee in connection with the business of operating a ship, or ships, in international traffic:

- the rental on a charter basis of ships

- the sale of tickets or similar documents

- the use, maintenance or rental of containers

- the management of the crew of ships.

The chartering of ships on a bareboat basis does not fall within the scope of a Shipping Business because the entity which charters the ship does not operate the ship. This activity may however fall within the scope of a Lease-Finance Business (depending on the terms of the bareboat charter arrangement).

Travel agencies and international shipping agencies will not be treated as carrying on a Shipping Business merely on the basis of selling tickets to passengers for international travel by ship. Entities that arrange for their own or other businesses’ goods to be transported overseas by sea are also not considered engaged in a Shipping Business, unless they themselves operate the relevant ships.

Core Income-Generating Activities of a Shipping Business

The Regulations mention the following CIGAs for a Shipping Business:

- ‘Managing crew (including hiring, paying and overseeing crew members)’ – This CIGA could include the sourcing, recruitment, selection, deployment, scheduling, training, and on-going management of the crew deployed on the vessels, including the associated administration (payroll, insurance, tax and social security withholding) and logistics (travel arrangements, temporary accommodation etc.).

- ‘Overhauling and maintaining ships’ – This CIGA involves having responsibility for, and the related decision making in respect of, the lifting of vessels from the water for maintenance and the general maintenance of ships.

- ‘Overseeing and tracking shipping’ – This CIGA refers to the management and oversight of the logistical aspects of the international transportation of cargo and passengers by ship, including overseeing and managing ship movements.

- ‘Determining what goods to order and when to deliver them, organising and overseeing voyages’ – This CIGA involves activities to determine how a ship is to be utilised, the types of cargo acceptable and the scheduling of the delivery of such cargos, managing the logistical aspects of the operation of ships, determining which routes to use, and ensuring necessary contingency arrangements are in place.

Examples:

- Water LLC owns a passenger ship and its business is to operate that ship in international traffic to carry passengers from the UAE to other Middle East countries. Water LLC is within the scope of a Shipping Business because it operates a ship in international traffic for the transport of passengers.

SailorCorp LLC provides and manages the crew of Fourth Fleet LLC’s ship as part of its crew management business, but SailorCorp LLC does not operate the ship. SailorCorp LLC is not related to Fourth Fleet LLC.

SailorCorp LLC is not considered to carry on a Shipping Business because it does not operate the ships where its crew is being deployed. The mere provision of crew and ship management services is not considered as “operating a ship” for purposes of the Regulations.

Because SailorCorp LLC is not related to Fourth Fleet LLC, SailorCorp LLC would also not be within the scope of the Regulations as a “Distribution and Service Centre Business”.

- Charter LLC owns a ship and charters it on a bareboat basis to Cargo LLC that uses and operates the ship to carry cargo from the UAE to other countries.

Charter LLC does not operate the ship it has chartered to Cargo LLC, or any other ship, and is therefore not considered engaged in a Shipping Business.

Cargo LLC, on the other hand, is considered as carrying on a Shipping Business because it operates the ship it has chartered for the international transportation of cargo. It is not relevant that Cargo LLC is not the owner of the ship.

3.7 Holding Company Business

A Holding Company Business is defined under Article 1 of the Regulations as a business that:

(a) Is a Holding Company in accordance with the law applicable to the Licensee carrying out such activity

(b) has as its primary function the acquisition and holding of shares or equitable interests in other companies

(c) does not carry on any other commercial activity

Equity interests include shares in a company and interests in an incorporated partnership, as well as any other instrument which gives the Licensee a beneficial ownership interest in a company.

A Licensee whose activities are limited to being engaged in a Holding Company Business would only be required to meet the reduced economic substance requirements under Article 6.4 of the Regulations.

A UAE business that does not meet the narrow definition of a Holding Company Business because it either:

(i) carries on another activity; and/or

(ii) owns other forms of investments or assets (e.g. interest-bearing loans)

may be required to meet the (full or increased) economic substance requirements under Article 6.2 of the Regulations if the other activity or asset brings the UAE business within the scope of a different Relevant Activity category (e.g. Lease-Finance), and the Licensee derives gross income from such other Relevant Activity.

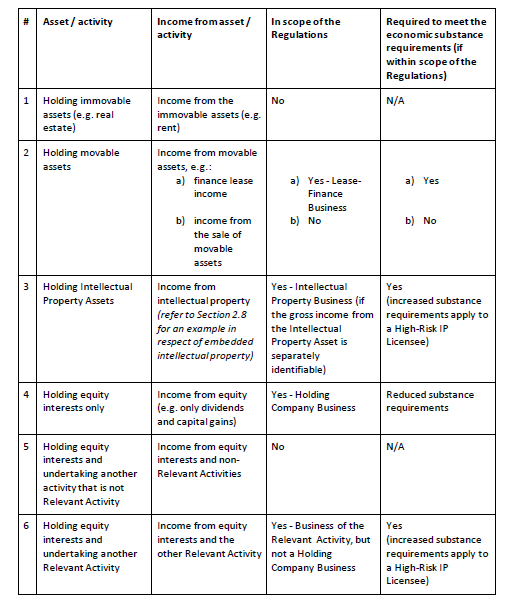

The following table provides examples of how a UAE business may assess its obligations under the Regulations in the above circumstances.

Core Income-Generating Activities of a Holding Company Business

The CIGAs of a Holding Company Business are all activities related to acquiring and holding shares or equitable interests in other companies, provided that such activities do not constitute another Relevant Activity, in which case, the CIGAs shall be those related to that other Relevant Activity.

Examples:

- ABC LLC’s only activity is the holding of shares in four subsidiary companies, and ABC LLC is itself held by the regional holding company of the group headquartered in France. The only gross income earned by ABC LLC are annual dividends from its subsidiaries.

ABC LLC undertakes a Holding Company Business irrespective of its own shares being held by another holding company in the group.

- DEF LLC manufactures food products, and holds the shares in another company (GHI LLC) which operates a restaurant.

Despite DEF LLC holding the shares of GHI LLC and earning dividend income, DEF LLC is not considered a Holding Company Business because its business is food production.

Because the manufacturing of food products and the operation of restaurants does not meet the definition of any of the other Relevant Activities, neither DEF LLC nor GHI LLC are subject to the Regulations.

- GHI LLC holds 100% of the shares in two subsidiary companies, and has provided an interest bearing shareholder loan to one of these companies. GHI LLC earns annual dividends and interest income.

GHI LLC will be considered as engaged in a Lease-Finance Business only, and not also considered as carrying on a Holding Company Business.

- Trustee LLC acts as trustee to a number of unconnected trusts, holding assets in its capacity as trustee. As Trustee LLC is in the business of providing trustee services and is not the beneficial owner of the assets, Trustee LLC will not be considered a Holding Company Business.

3.8 Intellectual Property Business

A UAE business is regarded as carrying on an Intellectual Property Business if it holds, exploits, or receives gross income from “Intellectual Property Assets”.

An Intellectual Property Asset is defined as any intellectual property right in intangible assets, such as copyrights, patents, trademarks, brands, and technical know-how, from which the Licensee earns separately identifiable income in the form of royalties, license fees, franchise fees, capital gains and any other income from the sale or exploitation of the Intellectual Property Asset.

Most UAE businesses will own some form of Intellectual Property Asset (e.g. their trademark, technical know-how relating to their processes, copyright in their works etc.), but not earn separately identifiable income from such assets. Instead, the Intellectual Property Assets contribute to, or protect the value of, the good or services these UAE businesses provide. The ownership of such Intellectual Property Asset would not be considered as carrying on an Intellectual Property Business as the Intellectual Property Asset is merely auxiliary to the main business of the UAE business.

If there is any indication that a Licensee has manipulated its gross income to avoid being subject to the economic substance requirements as an Intellectual Property Business, for example, by disguising royalties as part of sales income, the Regulatory Authority shall take the necessary action to ensure compliance with the Regulations.

Core Income-Generating Activities of an Intellectual Property Business

The Regulations set out certain CIGAs for an Intellectual Property Business. The CIGA required to be undertaken in the UAE will depend on the nature of the asset being exploited and how that asset is being used to generate gross income for the Licensee.

Patents and similar assets (e.g. that share the same features of a patent including copyrighted software, technical know-how and other similar novel, useful and protected assets): ‘Research and development’.

This CIGA includes planning and documentation of new products, processes or services, prototyping, demonstrating, piloting, testing and validation of new or improved technologies, addressing known scientific or technological obstacles, applying research findings or other knowledge for producing or introducing new or improved materials, devices, products, processes, systems, technologies or services, etc.

Marketing intangibles (an intangible that relates to marketing activities, aids in the commercial

exploitation of a product or service, and/or has an important promotional value for the product

concerned such as trademarks, brands, customer lists and relationships): ‘Branding, marketing and distribution’.

Marketing and branding includes advertising, seeking endorsements, artistic design, developing consumer awareness and developing customer loyalty.

Distribution includes distribution of the marketing intangible through various mediums such as on demand services, business to business sectors, integration into IT systems, creating dealership networks and distribution channels and maintaining relationships to aid in the distribution of the marketing intangible.

In demonstrating economic substance in the UAE for an Intellectual Property Business, periodic decisions made by non-resident directors would not be sufficient to satisfy the economic substance test. Therefore, it would require more than local staff passively holding intangible assets whose creation and exploitation is a function of decisions made and activities performed outside of the jurisdiction.

Examples:

- LicenseCo holds a brand, the rights for which are licensed to others in return for a royalty. LicenseCo is within the scope of an Intellectual Property Business.

- ChocolateCo has a trademarked range of chocolates, which it manufactures and sells to unrelated third parties.

ChocolateCo is not an Intellectual Property Business as its gross income is derived from the sale of finished goods to third parties, not the exploitation of an Intellectual Property Asset (i.e. the value of the trademark is intrinsically linked to the value of the chocolates and is not separately distinguishable making the use of the trademark incidental).

- SoftwareCo has developed a unique IT software platform for accepting, processing and tracking online orders that it holds and uses within its own business of online marketing. SoftwareCo also licences the IP software platform to others to use within their online marketing businesses. The users pay SoftwareCo a licence fee in order to use the IT software platform. SoftwareCo is within the scope of an Intellectual Property Business.

High Risk IP Licensee

Where a Licensee is carrying on an Intellectual Property Business, it will also have to consider if it is a High Risk IP Licensee. A High Risk IP Licensee is defined under Article 1 of the Economic Substance Regulations as a Licensee which carries on an Intellectual Property Business, and under condition (a) of the definition meets all of the following three requirements:

- The Licensee did not create the Intellectual Property Asset which it holds for the purpose of its business, and

- The Licensee acquired the IP Asset from either; A group company, or In consideration for funding research and development by another person situated in foreign jurisdiction, and

- The Licensee licenses or has sold the IP Asset to one or more group companies, or otherwise earns separately identifiable gross income (e.g. royalties, licence fees) from a foreign group company in respect of the use or exploitation of the IP asset.

Any High Risk IP Licensee is, by default, deemed to have failed the economic substance test, resulting in the Competent Authority exchanging information on the High Risk IP Licensee with the relevant Foreign Competent Authorities (where the Parent Company, Ultimate Parent Company and the Ultimate Beneficial Owner of the High Risk IP Licensee are resident).

A High Risk IP Licensee would nevertheless be required to meet the economic substance test to avoid being subject to penalties, by providing sufficient evidence supporting that it has, and has historically had, a high degree of control over the development, enhancement, maintenance, protection and exploitation (the so-called “DEMPE functions”) of the Intellectual Property Asset.

The Licensee is required to have an adequate number of full-time employees, with the necessary qualifications, who permanently reside and perform their activities in the UAE, and would need to provide the following information:

- A business plan showing the reasons for holding the ownership in the Intellectual Property Asset in the UAE;

- Employee information, including;

○ level of experience;

○ type of contracts;

○ qualifications; and

○ duration of employment of the Licensee;

- The above information would have to prove that in the UAE there is more than local staff passively holding intangible assets whose creation and exploitation is a function of decisions made and activities performed outside of the jurisdiction. As such, the business would need to evidence that decision making is taking place in the UAE (note: periodic decisions made by non-resident directors or board of members would not be sufficient).

Example:

- PharmaCorp LLC, a UAE resident company earns gross income from licensing its patent for a new medicine to its group companies located in Egypt and KSA.

PharmaCorp did not create the patent, the rights were acquired from a group company (R&D Co in the UK).

PharmaCorp is a High Risk IP Licensee and would (i) be subject to the exchange of information provisions of Article 9.3, and (ii) be required to provide additional information to evidence its economic substance in the UAE.

3.9 Distribution and Service Centre Business

A “Distribution and Service Centre” Business refers to two distinct activities that are covered under one “Relevant Activity” heading.

A Licensee is considered engaged in a “Distribution Business” if the Licensee purchases raw materials or finished products from a foreign group company, and distributes those raw materials or finished goods.

A Licensee is considered engaged in a “Service Centre Business” if it provides consulting, administrative or other services to a foreign group company,and those services are in connection with the foreign group company’s business outside the UAE.

Licensees that only purchase goods from or distribute goods to third parties are not considered engaged in a Distribution Business. Likewise, Licensees that are engaged in the business of providing services to third parties are not considered as carrying on a “Service Centre Business”.

An entity that undertakes a transaction that falls within the scope of a “Distribution and Service Centre Business” would not be required to demonstrate economic substance in the UAE if it can evidence that the transaction was not in the ordinary course of its business (e.g. a one-off transaction) and the transaction is recharged to the relevant foreign group company at cost or less.

Licensees engaged in Banking, Insurance, Investment Fund Management, Lease-Finance, Shipping, or Headquarter Business may also purchase goods for, and/or provide services to foreign group companies as a normal part of their business operations. To prevent duplicate reporting, such Licensees are not also considered engaged in a Distribution and Service Centre Business.

Core Income Generating Activities of a Distribution and Service Centre Business

The Regulations mention the below CIGAs for Distribution and Service Centre Business.

The CIGA in relation to “Distribution Business”:

- ‘Transporting and storing goods, components and materials or goods ready for sale’ – This CIGA refers to the movement and storage of raw materials or finished products and managing the risks associated with this.

- ‘Managing inventories’ – This CIGA could include considering minimum acceptable inventory levels, managing frequency of stocktake, whether using storage space effectively, perishability of inventory and ensuring security procedures are in place.

- ‘Taking orders’- This CIGA refers to the provision of the order processing element of the entire fulfilment process, whether that is manual or electronic.

The following CIGAs generally apply in relation to a “Service Centre Business”:

- ‘Providing consulting or other administrative services’- This CIGA covers the provision of any type of service to the Licensee’s foreign group companies.

Examples:

- XYZ LLC (UAE) buys furniture from a group company based in Lebanon and then re-sells the furniture throughout the Middle East. XYZ LLC is considered as carrying on a Distribution and Service Centre Business.

- The main business activity of TUV LLC (a company established in the Ajman Free Zone) is to provide HR and administrative support services to a group company based in Kuwait, which are recharged at cost. Despite TUV LLV not charging a mark-up on the relevant costs, TUV LLC is considered as engaged in a Distribution and Service Centre Business.

- HIG LLC, the KSA subsidiary of ABC LLC (a company established in the United Kingdom), requires specialist IT support with the implementation of a new accounting system which will be used by HIG LLC in the provision of services to KSA based clients. QRS LLC (a subsidiary of HIG LLC established in the Abu Dhabi General Markets Financial Free Zone) provides audit and accountancy services to third party customers in the UAE, and agrees to second one of its IT support staff to HIG LLC for three months. QRS LLC recharges HIG LLC the relevant salary costs incurred.

As QRS LLC is not in the business of providing IT services to foreign group companies, nor does it offer/solicit such services or maintain employees to provide such services to other group companies, and because it does not earn a margin on the costs recharged to HIG LLC, QRS LLC is not considered as carrying on a Distribution and Service Centre Business.

- Professional advice

If a business is unable to determine whether it conducts a Relevant Activity, it should seek professional advice.

For a professional advice and free consultation to check whether ESR is applicable to your business or not, please contact us: tel: +971 4 269 9329 | mail: [email protected] | mob : +971 50 986 6466

This articel is based on the guide issued by Ministry of Finance UAE. You can download the full guide issued by UAE Ministry of Finance from Here

or by visiting https://www.mof.gov.ae

contact us

contact us